Last week, I flew out to NYC for a quick turnaround trip and a PLI panel about Reincorporations and Redomestications. It was a part of a two-day program on Mergers & Acquisitions 2026: Advanced Trends and Developments.

Our panel featured Steve Haas from Hunton , Charlotte Newell from Sidley, and Robert Rosenberg from Houlihan Lokey. You can access the panel from PLI’s website.

Both Hunton and Sidley have put out interesting things on corporate law issues that have been on my radar. Charlotte has covered Delaware litigation and has expertise on the current state of play there as Delaware lawyer. Steve recently drafted an article for the American Bar Association: Delaware Supreme Court Establishes Test for Reviewing Reincorporation Decisions.

Although I can’t speak for the other panelists here, I think we all expect that Delaware will remain king of the hill by a substantial margin. There have been some shifts and some companies moving, but Delaware will continue to grow both in terms of overall numbers from private entity formation, public company IPOs, and public companies deciding to move to Delaware from other jurisdictions. Delaware’s overall numbers depend on both DExits and DEntries. Companies sometimes shift their incorporation from one jurisdiction to another. As long as more are moving in than moving out, Delaware will continue to grow. Delaware has a dominant product. That isn’t likely to change anytime soon. But that doesn’t mean that there isn’t any room for other states to offer alternatives.

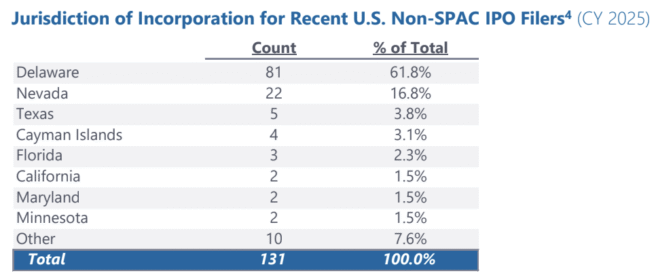

Robert also came in with detailed slide deck with granular data. He looked at some historical moves like Costco in 1998 and Microsoft in 1993 and also pulled in recent IPO data. Most years, Delaware gets about 80% of IPOs. But 2025 looked a little different.

Nevada pulled in about 16.8% of IPOs and Delaware came in with 61.8%, picking up another 81 public companies. That’s a bigger number than the number of companies that left Delaware last year. As expected, Delaware continues to grow at a nice clip.

I haven’t yet gone an identified the 22 IPO firms and looked to see if they have any interesting or explanatory characteristics yet. Fortunately, law students are always looking for research projects and this could be an interesting one.

Ultimately, if this trend holds, it may be possible for Nevada to start accumulating more companies with IPOs. This doesn’t mean that corporate law will turn into our primary economic driver anytime soon, but it could help diversify Nevada’s economy and make it easier for me to find my students jobs in business law.