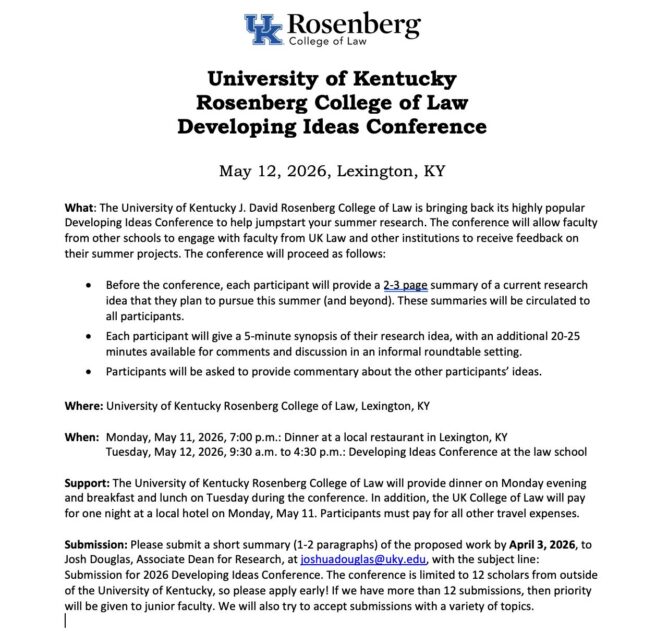

Jumpstarting summer research? Getting feedback on your work? Lexington, KY in the spring? Those are all positives to me! Contact Josh Douglas with questions. Hat tip to friend-of-the-BLPB Tom Rutledge, Kentucky lawyer supreme, for prompting this post.