Tracking reincorporations to Nevada and Texas in 2025 also gave me time to think about ways to do a better job than the simple tables I put out last year. For 2026, I’ve pulled in some research assistants for what we’re calling Project Pokémon. In essence, instead of just trying to catch public company moves to Nevada or Texas, we’re working to catch them all this time. For example, there are already two announced attempts to move to Delaware–LQR House and Cheetah Net. As this year progresses, I’m aiming to present snapshots of the overall picture, not just the action going to two states.

Here is some of what I have so far.

Announced 2026 Moves As of Jan. 30, 2026

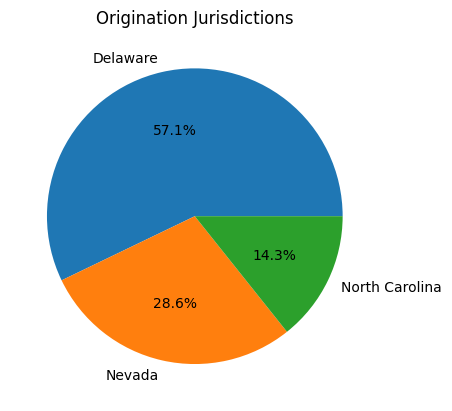

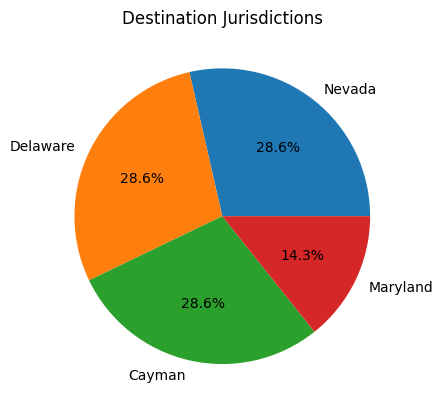

| Company Name | Stock Ticker | Origination State | Destination State | First Announcement Date |

| TruGolf | TRUG | Delaware | Nevada | 1/13/2026 |

| Forian, Inc. | FORA | Delaware | Maryland | 12/4/2025 |

| LQR House | YHC | Nevada | Delaware | 1/16/2026 |

| CBAK Energy | CBAT | Nevada | Cayman | 1/16/2026 |

| Cheetah Net | CTNT | North Carolina | Delaware | 12/5/2025 |

| Galecto | GLTO | Delaware | Cayman | 12/16/2025 |

| Resolute Holdings Management, Inc. | RHLD | Delaware | Nevada | 1/30/2026 |

I’m hopeful my infographic capabilities will improve this year, but here are some basic pie charts to get us started.

This is the current working list that tracks more information. One of the challenges we’re working through right now is how to make this information easy to read in a blog post. My simple word table worked well enough last year to port over for posts, but it’s harder to display the spreadsheet we’re now working with. We’re tracking:

- Origination State

- Destination State

- First Announcement Date

- Definitive Proxy or Information Statement Date

- Scheduled Vote Date

- Votes In Favor

- Votes Against

- Abstentions/Non-Votes

- Proposal Pass or Fail

- Controlled Company Status*

- Rough Market Capitalizaton

- Franchise Tax Fees

- Notes

If you have other things we should be tracking around these, email me and I’ll see if we can gather it efficiently.

As we’re working this out, one of the things we need to decide is how to define what is and is not a controlled company. States have different definitions and I’m going to either need to look at how they would be classified under different state laws or come up with a simple way just for tracking purposes here.

2026 Predictions

It’s early still and we’ll have to see what happens, but here are my predictions for this year:

- There will be more shifts from one state to another in 2026 than in 2025.

- Nevada will continue to do well with large founder-led firms.

- Nevada will continue to attract smaller companies.

- Some companies will shift to jurisdictions where they have significant existing ties.

- Texas will pick up a number of large companies that already have a Texas headquarters or significant Texas operations.

- Texas will pick up companies via IPO when they have substantial Texas operations.

One Of These Is Not Like The Others–Resolute Holdings

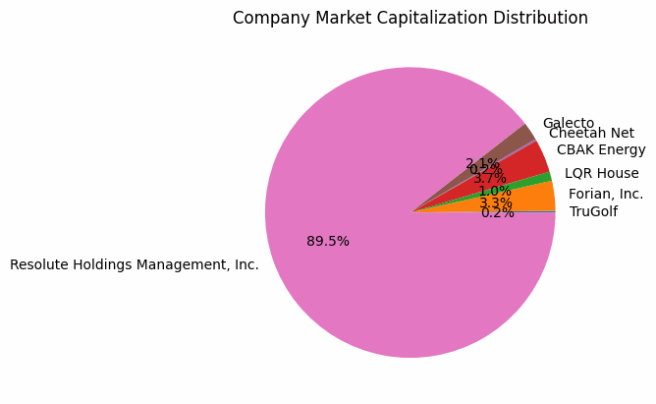

Most of the moves we’ve identified so far involve relatively smaller public companies. But Resolute Holdings has a substantially larger market cap than the rest of the field so far combined.

The company has a market capitalization of about $1.7 billion and exited Delaware via written consent. The consenting stockholders together hold “approximately 50.5% of the voting power of the outstanding shares of capital stock of the Company.” The information statement explains that the Board received advice from Paul, Weiss, Rifkind, Wharton & Garrison LLP and that outside counsel “advised our senior management on, among other things: differences in corporate law in Delaware, Nevada and Texas; certain risks to remaining in Delaware and certain potential benefits to exiting Delaware; and a potential timeline for reincorporating the Company. Here are some bits from the information statement. The italicized subheadings are my own for clarity and breaking it up.

Predictable, Statute-Focused Legal Environment

The “board of directors determined that it would be advantageous for the Company to be able to operate with agility in a predictable, statute-focused legal environment, which will better allow the Company to respond to emerging business trends and conditions as needed. Our board of directors considered Nevada’s statute-focused approach to corporate law and other merits of Nevada law, including that, among other things, the Nevada statutes codify the fiduciary duties of directors and officers, which has the potential to decrease reliance on judicial interpretation and promote stability and certainty for corporate decision-making.”

Litigation Environment Considerations

“Our board of directors also considered the increasingly active litigation environment in Delaware, which has engendered costly and often meritless litigation and has the potential to cause unnecessary distraction to the Company’s directors and management team.”

Jury Waiver

One of the things Nevada did in the 2025 legislative session was create a degree of parity with Delaware by authorizing companies to include provisions in their articles of incorporation to opt into bench trials as in Chancery and out of jury trials. Resolute Holdings elected to have bench trials. It would surprise me if a company did not elect to have a bench trial.

Delaware’s Dividend Difference

LQR House now looks to shift from Nevada to Delaware. It identifies differences in dividend policy as significant:

a Delaware corporation has greater flexibility in declaring dividends, which can aid a corporation in marketing various classes or series of dividend paying securities. Under Delaware law, dividends may be paid out of surplus, or if there is no surplus, out of net profits from the corporation’s previous fiscal year or the fiscal year in which the dividend is declared, or both, so long as there remains in the stated capital account an amount equal to the par value represented by all shares of the corporation’s stock, if any, having a preference upon the distribution of assets. Under Nevada law, dividends may be paid by the corporation unless after giving effect to the distribution, the corporation would not be able to pay its debts as they come due in the usual course of business, or (unless the corporation’s articles of incorporation permit otherwise) the corporation’s total assets would be less than the sum of its total liabilities, plus amounts payable in dissolution to holders of shares carrying a liquidation preference over the class of shares to which a dividend is declared. These and other differences between Nevada’s and Delaware’s corporate laws are more fully explained below.

Final Thoughts

It’s early yet, but it will be interesting to watch this space and track how it develops. I expect Texas will be on the board soon. Ultimately, proxy season won’t start in earnest for some time and it will be difficult to draw many conclusions until we hit that period.

LQR House looking to shift from Nevada to Delaware sits in tension with claims that you can do anything you want in Nevada that you can’t do in Delaware. When it comes to declaring dividends, Delaware appears more permissive than Nevada now.