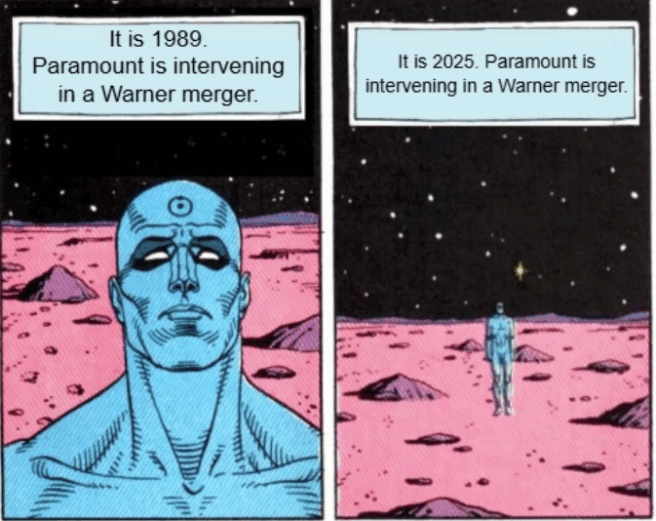

Obviously, the big business news today is the Netflix/Warner merger agreement, coupled with party-crasher Paramount.

This is not, of course, the first time that Paramount has interrupted a Warner merger deal. As probably everyone reading this post already knows, back in the late 80s, Time signed a merger agreement with Warner, and Paramount parachuted in with an offer to take over Time instead. When Time locked up the merger agreement too tightly for Paramount to get a foothold, it sued in Delaware, and lost before the Delaware Supreme Court in Paramount v. Time.

A lot of the mainstream news reporting is presenting Paramount’s topping bid for Netflix as a “hostile” tender offer, echoing Paramount’s claim that it is taking its bid directly to the shareholders. That is … not exactly accurate.

No one does hostile tender offers anymore, in the sense of an actual for-real offer to buy shares without approval of the target board. That’s because, after cases like Paramount v. Time, boards have fairly broad powers to prevent unapproved acquisitions – like, poison pills, and DGCL 203. So, this Paramount offer is actually a proposal for a friendly 251(h) merger, conditioned explicitly on the approval of Warner’s board:

Consummation of the Offer is conditioned upon, among other things, the following conditions: (i) Warner Bros. shall have entered into a definitive merger agreement with Paramount and the Purchaser substantially in the form of the merger agreement submitted by Paramount to Warner Bros. on December 4, 2025 and attached to the Offer to Purchase as part of Annex A (the “Paramount/Warner Bros. Merger Agreement”), other than changes required to reflect completion of the Offer followed by a second-step merger under Section 251(h) of the DGCL and any other changes mutually agreed between Warner Bros. and Paramount

Which means, Paramount is only taking its bid to the shareholders in the sense that it’s hoping Warner shareholders will pressure Warner’s board into terminating the Netflix deal and accepting Paramount’s offer.

Beyond that, is there any way Paramount – or Warner shareholders – can actually force Warner to accept Paramount’s bid if it remains adamant about the Netflix deal?

Well, there’s always the possibility of a lawsuit alleging breach of fiduciary duty – Paramount has already suggested that Warner prefers Netflix’s bid because David Zaslav personally favors Netflix. And Paramount could run a proxy contest to replace Warner’s board.

Beyond that, though, the only legal leverage Paramount has is that the Netflix transaction requires a shareholder vote. Presumably, if shareholders vote down that deal – and take Netflix off the table – that would persuade Warner to come back to Paramount. That is, of course, largely what happened when JetBlue made a topping bid for Spirit Airlines after Spirit signed a deal with Frontier. When it became clear that shareholders preferred JetBlue’s offer and would vote down the Frontier transaction, Spirit’s board broke it off with Frontier and signed with JetBlue (which ended … badly).

Back in the old Paramount v. Time fight, Time, too, was worried that its shareholders would prefer Paramount’s offer to the Warner deal, and vote down Warner. So, it actually restructured the transaction to avoid a vote of its own shareholders.

Can Warner do that? Actually, yes, in a way. Remember, the Netflix deal has two parts. A spinoff of the news assets into a separate company, after which Netflix buys the remainder. The current merger agreement contemplates a shareholder vote before any reorganization measures take place. But I don’t believe there’s any legal reason why the vote can’t take place after the spinoff, which itself doesn’t (I think???) require a vote at all (let me know if that’s wrong, by the way).

If that were to happen, well, after the spinoff, Warner would be a different company, and presumably Paramount’s offer would be dead, or at least have to be substantially revised – which would functionally force Warner’s shareholders into Netflix’s loving arms.

But if Warner were to revise the agreement in that way, it would almost certainly draw legal challenge – and very likely Warner would lose. When Time restructured an agreement to avoid a shareholder vote, it was doing so in contemplation of a long-term plan subject to business judgment; Warner, however, is in Revlon-land, and it can’t justify, essentially, cutting off a bidding war and coercing a transaction on the grounds that it believes the company has a brighter long term future in the new structure.

Now, let’s take a moment to go back to the lawsuit idea. Presumably, if Warner remains adamant, Paramount (or Warner shareholders) could sue Warner’s board alleging breach of fiduciary duty because Warner unreasonably has favored Netflix. That’s a difficult argument because, dollar for dollar, the Netflix transaction might offer more value to shareholders (Netflix is offering less than Paramount, but Warner shareholders get to keep the spun off news business). So, the argument would have to be something like unreasonable process (i.e., Warner just liked Netflix better for improper reasons), and higher regulatory barriers/less deal certainty for the Netflix merger.

But then we run into the problem I blogged about when Pfizer, Metsera, and Novo were dancing this dance – namely, the implicit (and sometimes explicit) argument in Paramount’s favor is that the Trump Administration wants the Ellisons to buy Warner so they can kill CNN. If that’s what ends up in Delaware, how is a Chancery judge supposed to weigh it?